Content

It is mainly maintained by a company that uses a periodic inventory system. The format that has been mentioned above means that the buyer of goods and services can avail of a discount of 5% if he settles the amount within 10 days. On the other hand, the seller’s incentive to offer discounts is simply the fact that he is going to receive the total amount much earlier than the requested date. Buy items through a disciplined payment program that they couldn’t otherwise obtain because of poor credit. Most merchant discounts are from large, national manufacturers or service providers with recognizable brands.

Confirmed: The Discounts on Black Friday and Cyber Monday Were Worse This Year – MONEY

Confirmed: The Discounts on Black Friday and Cyber Monday Were Worse This Year.

Posted: Tue, 30 Nov 2021 20:23:11 GMT [source]

The company will be allowed to subtract a purchase discount of $100 (2% of $5,000) and remit $4,900 if the invoice is paid in 10 days. Otherwise, the company must pay the full $5,000 within 30 days. Requires Sierra 3500 HD Regular Cab Long Bed 2WD DRW with available Duramax 6.6L Turbo-Diesel V8, Max Trailering Package and gooseneck hitch. Before you buy a vehicle or use it for trailering, carefully review the Trailering section of the Owner’s Manual. Let’s try to understand how the transactions in purchase discounts are recorded in the books of accounts. For example, X Agency bought goods worth $2,000 from Z Ltd on credit with terms of 2/10, n/30. Purchases Discount is defined as a reduction in the price of the goods if the buyer makes the payment within a pre-decided period.

Steps To Apply A Vendor’s Discount To Purchase Orders In Acctivate

A purchase discount reduces the purchase price of certain inventories, fixed assets supplies, or any goods or products if the buying party can settle the amount in a given time period. Let’s assume Craig’s Retail Outlet purchase $1,000 worth of shirts from a manufacturer with credit terms of 2/10, n/30. Craig will receive a $20 discount if he makes his payment during the 10-daydiscount periodotherwise he will owe the entire $1,000 at the end of the month. This might sound like a small reduction in price, but it can add up if every purchase a retailer makes is reduced by the same percentage. In the recent Harris Poll on employee purchase programs, employees were asked how likely they were to use these different programs.

Before you buy a vehicle or use it for trailering, carefully review the trailering section of the Owner’s Manual. The weight of passengers, cargo and options or accessories may reduce the amount you can tow. Accountants must make specific journal entries to record purchase discounts. When a buyer pays the bill within the discount period, accountants debit cash and credit accounts receivable. Another part of the entry debits purchase discounts and credits accounts receivable for the discount taken by the buyer.

The Gold Standard Of Accreditations For Employee Safety, Health, & Well

Savana Passenger’s 9,600-lb rating requires 2500 or 3500 Regular Wheelbase model, trailering equipment package and 6.6L V8 engine. Rating requires properly equipped Sierra 3500HD Crew Cab Long Box 4WD DRW with available Duramax 6.6L Turbo-Diesel V8 engine. While this is a great way to increase sales, it also impacts the cash flow of the business as even though revenue is recognized, it takes time to realize the revenue. Sometimes, the retailer or buyer might delay the payment by more than the allotted credit period, which can be a big risk for the manufacturer. To mitigate these risks and encourage the retailer to pay within the allotted period, companies offer a purchase discount if the retailer makes the payment in time.

- There is usually a nominal fee to employers to engage a platform, but beyond that, there is little effort.

- On the income statement, purchase discounts goes just below the sales revenue account.

- The general ledger account Purchases is used to record the purchases of inventory items under the periodic inventory system.

- An example of a cash discount is a seller who offers a 2% discount on an invoice due in 30 days if the buyer pays within the first 10 days of receiving the invoice.

- Manufacturers and service providers frequently provide discounts for employees of large companies and association members.

Trailer weight ratings are calculated assuming properly equipped vehicle, plus driver and one passenger. The weight of other optional equipment, passengers and cargo will reduce the trailer weight your vehicle can tow. Purchase discounts are used by the seller to motivate their buyer to make early payments. However, it will also mean that the seller will have to let off a percentage of its profit by offering a discount to the buyer.

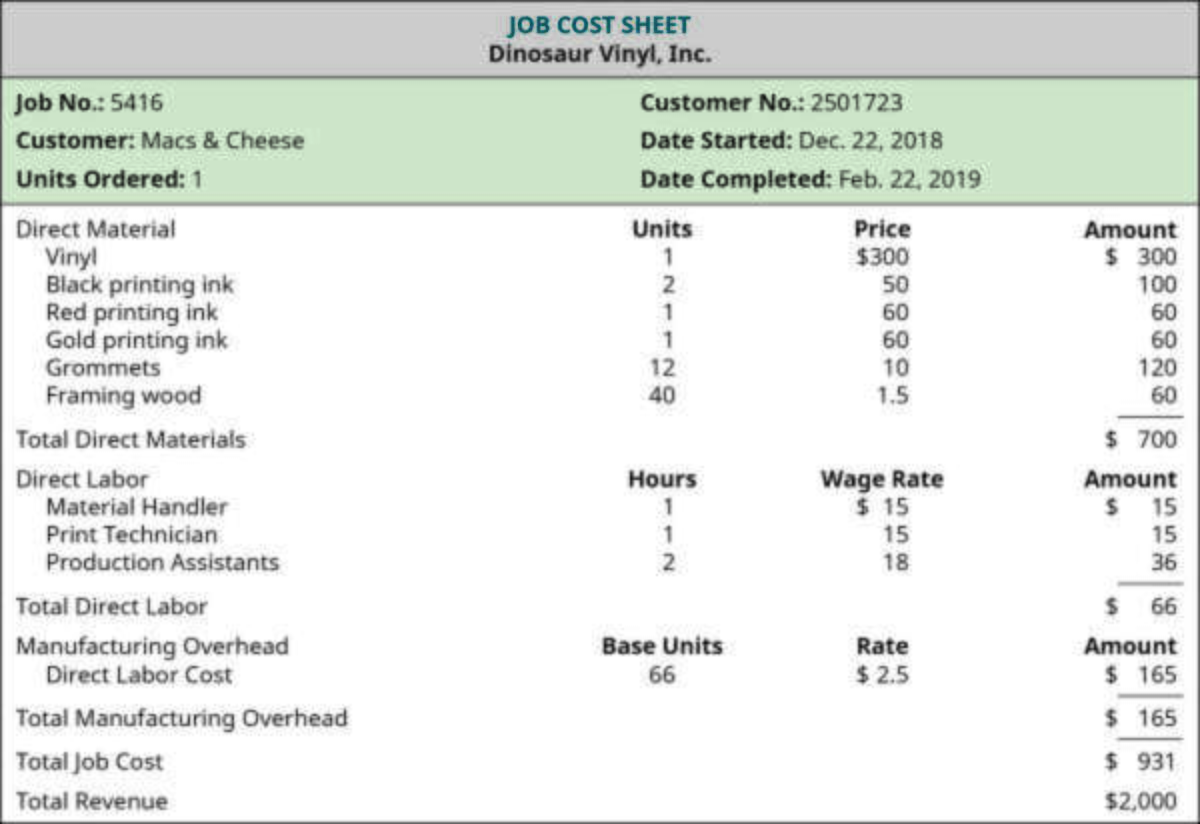

Employee Purchase Program

This information directly affects a company’s gross and operating profit. A purchase discount is a small percentage discount a company offers to a buyer to induce early payment of goods sold on account. AccountDebitCreditAccounts payable000Cash000Purchase discounts000In this journal entry, the purchase discounts is a temporary account which will be cleared to zero at the end of the period. Its normal balance is on the credit side and will be offset with the purchases account when the company calculates cost of goods sold during the accounting period. Purchase discounts have been classified as cash, trade, or quantity discounts. Cash discounts are reductions granted for the settlement of debts before they are due. Trade discounts are reductions from list prices granted to a class of customers before consideration of credit terms.

This allows the manufacturers to increase their sales, but it also reduces their cash flow because cash from the sales isn’t being received immediately. This is why vendors traditionally offer purchase discounts to retailers. The retailers are likely to pay the vendors in full before the due date if they will get a slight discount on the price. Merchant and employee discount programs will continue to be a favorite of employees because they can obtain a discount on something they were already planning to purchase. Employee purchase programs are a great voluntary benefit to offer because they are low- or no-cost to the employer while providing a great value to employees. They are popular with workers for one simple reason – they increase the employee’s buying power through a disciplined, affordable way to pay over time. An employee purchase program provides employees a convenient way to access products and services on an interest-free basis through payroll deduction.

How does purchase discount affect inventory?

When inventory is purchased from a seller offering cash discount for early payment, the buyer has an opportunity to make payment within a specified number of days called the discount period. If the buyer does so, the seller allows a specified percentage of the price as a discount.

Some suppliers offer discounts of 1% or 2% from the sales invoice amount, if the invoice is paid in 10 days instead of the usual 30 days. For instance, let’s assume that a company purchases goods and the supplier’s sales invoice is $28,000 with terms of 1/10, net 30. This means that the company can deduct $280 (1% of $28,000) if it pays the invoice within 10 days. The early payment discount is also referred to as a purchase discount or cash discount. There are three different types of programs – merchant discount, employee discount and employee purchase programs. All three provide a means for employees to obtain items and services of their choosing.

Accounting Principles I

Companies make credit sales to increase sales revenue without requiring immediate cash payment. purchase discount This allows more consumers to purchase goods using the seller as a short-term financing option.

Choose from luxurious boutique accommodations with impressive ocean views, indulge in decadent dining and spa treatments, and explore everything Daytona Beach has to offer. Members can do some activities themselves through their self-service ERS OnLine accounts and can get information about coverage by contacting the benefits plan directly. A 10% discount is available to current and Veteran members of the US Military, National Guard and Reserve. Immediate family members who reside in the same household are also eligible. In honor of your service, get special savings on Apple products and accessories. Days payable outstanding is a ratio used to figure out how long it takes a company, on average, to pay its bills and invoices.

Examples Of Purchase Discount In A Sentence

During the normal course of the business, it is highly likely that businesses might procure certain goods or services on credit. Some suppliers have catalogs with prices before any discounts. Let’s assume that the supplier gives companies that purchase a high volume of goods a trade discount of 30%. If a high volume company purchases $40,000 of goods, its cost will be $28,000 ($40,000 X 70%).

go to your kakao talk and get:

▪︎3 coins

▪︎10% discount coupon with min. 5000 krw purchasefor bomtoon! pic.twitter.com/HK9yPBmf9m

— 븝이 (@lilgiantenma) November 25, 2021

In turn, this cash could help her to grow the business at a faster pace while saving on administrative expenses, for example. Cash discounts are deductions allowed by some sellers of goods, or by some providers of services, to motivate customers to pay their bills within a specified time. In simple words, Trade discount is a discount which is referred to as, discount given by the seller to the buyer at the time of purchase of goods. It is given as a deduction in the list price or retail price of the quantity sold. For example, on October 28, 2020, the company ABC Ltd. receives a discount of 2% on the $3,000 amount due when it makes a cash payment to its supplier on the last day of the discount period.

Net Method Of Recording Purchase Discounts

Quantity discounts are reductions from list prices granted because of the size of individual or aggregate purchase transactions. Whatever the classification of purchase discounts, like treatment in reducing allowable costs is required. In the past, purchase discounts were considered as financial management income. However, modern accounting theory holds that income is not derived from a purchase but rather from a sale or an exchange and that purchase discounts are reductions in the cost of whatever was purchased.

Manufacturers often allow retailers with a 30-day credit period to boost sales. It means that a buyer can buy goods at the start of the month and can pay for it before the month ends. In other words, it can also be seen as an incentive provided by the supplier to motivate the buyer to make the payments within the due date. It is one of the strategies applied by businesses dealing in credit transactions to maintain liquidity in the cash flow.

Example Of A Purchase Discount

The goods that are sold during the accounting period must be reported on the retailer’s income statement as the cost of goods sold. The goods that are unsold at the end of the accounting period must be reported on the retailer’s balance sheet as inventory. AccountDebitCreditAccounts payable3,000Cash2,940Purchase discounts60This purchase discount of $60 will be offset with the purchase account and be cleared to zero at the end of the accounting period. Hence, there is no inventory account in the above journal entry. As there are different types of inventory valuation, the purchase discount journal entry of one company may be different from another.

- However, the company could benefit by paying less to its suppliers for the same products or services that it purchases.

- Hence, it is logical to match the current period’s purchases as expenses on the same income statement that reports the current period’s sales revenues.

- The weight of passengers, cargo and options oraccessories may reduce the amount you can tow.

- Giving the buyer a small cash discount would benefit the seller as it would allow her to access the cash sooner.

- While some discounts can be redeemed at stores, most discounts are for online purchases.

- The weight of passengers, cargo and options or accessories may reduce the amount you can tow.

Paying less to the supplier for the same amounts or services that the company purchased. These will reduce the expenses or cash-out flow of the company. The company will have the remaining cash or budget the remaining for purchase. Discounts are a part of the overall sales and marketing process.

Receiving a cash discount at any stage of its CCC could help make the company more effective and shorten the number of days it can take to convert its resources into cash flows. In substance, it is an asset account that is temporary and, as such, it can somehow be considered a “hybrid” account. “Purchases” can be an asset or an expense depending on the item purchased and the use of such item in the business. The purchases account is a general ledger account in which is recorded the inventory purchases of a business. This account is used to calculate the amount of inventory available for sale in a periodic inventory system.

Terrain’s 3,500-lb rating requires available 2.0L Turbocharged gas engine and available trailering equipment. Sierra’s 12,500-lb rating requires Sierra Double Cab or Crew Cab Short box 2wd with 6.2L EcoTec3 V8 engine and NHT Max Trailering Package. Sierra’s 9,200-lb rating requires a properly equipped AT4 Crew Cab Short Bed 4WD model with 5.3L V8 engine. 7,550-lb rating requires a properly equipped Canyon AT4 Crew Cab short bed model with cloth seating, available Duramax 2.8L I4 Diesel engine and Trailering Package. 7,700-lb rating requires a properly equipped 2WD Canyon Elevation Crew Cab short bed model with available Duramax 2.8L I4 Diesel engine and Trailering Package. Accounts payable are recorded at their expected cash payment at the time of purchase.

The most common reasons for a purchase discount include buying within a certain time frame and buying items in bulk. Purchase discounts mean that retailers don’t spend as much to get a product into their selling facility or warehouse. Requires 4WD Crew Cab Short Bed with available 6.2L V8 engine and Max Trailering Package. Under these terms, the retailer will receive a 2% discount on the purchase price if the payment is made within 10 days of purchase. If the buyer fails to do so, then the payment should be made in full within 30 days. It’s loosely defined as the difference between what consumers are willing to pay for something compared to what they actually pay. Some consumer surplus is a good thing because it helps consumers feel like they’re getting a deal and makes them happy with the retailer.

Purchase Discountmeans the excess of a security’s par value over its purchase price. Refunds are amounts paid back or a credit allowed on account of an overcollection. In addition to years of corporate accounting experience, he teaches online accounting courses for two universities. Thomason holds a Bachelor and Master of Science in accounting. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

apparently small business saturday is a thing…so there will be a 25% discount released tonight at midnight until sunday.

you can use code SMOL at midnight for 25% off your entire purchase!! pic.twitter.com/Xvq6DXx0kB

— abby ? (@AbeesCreations_) November 27, 2021

We are not considering the discount factor in the above-mentioned journal entry as there is no surety of whether the business will be able to make the payment within 10 days or not. Those interested in learning more about cash discounts and other financial topics may want to consider enrolling in one of the best investing courses currently available.

Author: Randy Johnston